The Movement

A grassroots campaign demanding accountability and reparative justice from one of the world's wealthiest institutions.

ABOUT THE MOVEMENT

Tax Harvard. Exempt the Negro.

🔥 The Problem

For centuries, Black Americans—specifically, the descendants of American slaves—have carried the weight of labor stolen, wealth denied, and opportunities deferred.

Today, they continue to bear the cost — not only in wealth gaps and systemic exclusion, but even in how the tax code itself is designed. The same government that once legally counted Black people as 3/5 of a person continues to tax their descendants without ever addressing the unpaid debt of slavery.

Meanwhile, elite universities like Harvard, Yale, and Stanford — many of which directly profited from slavery and built their wealth atop its legacy — continue to enjoy enormous tax privileges, growing multi-billion dollar endowments shielded from full taxation.

✊ The Proposal

Tax Harvard. Exempt the Negro. The policy we propose is simple, yet powerful:

Exempt Black descendants of American slaves from federal income taxation.

Fund this new reparative exemption by revisiting how we tax elite endowments and wealth generally.

This is not about punishment. This is about finally recalibrating a tax system that has long subsidized privilege while extracting from the historically oppressed.

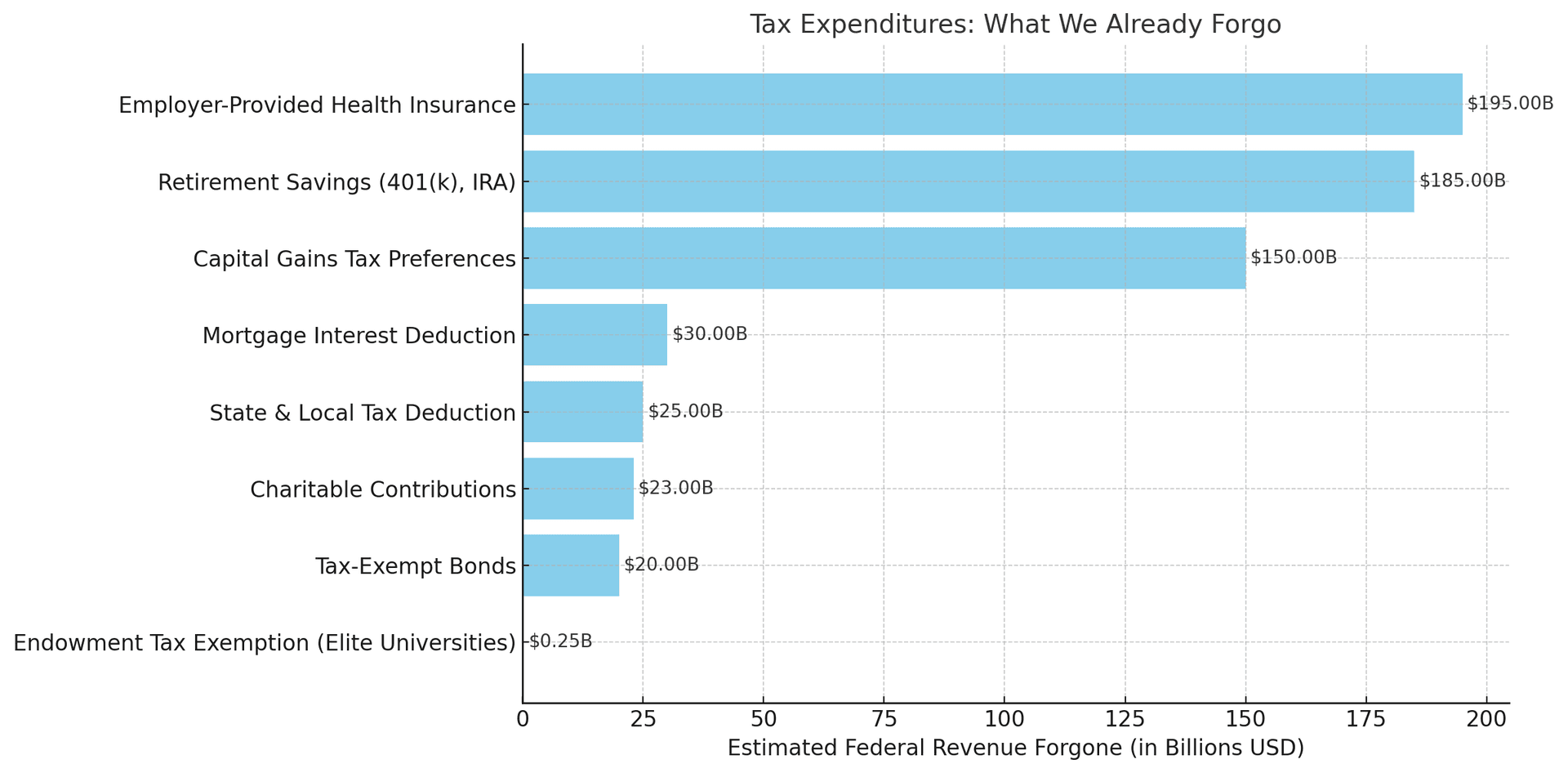

📊 What We Already Forgo

The truth: We already tolerate vast revenue losses — but for privilege, not repair.

$195B/year for tax-free employer health insurance

$185B/year for retirement accounts like 401(k)s

$150B/year for capital gains preferences

...and so on.

This exposes not a lack of resources — but a lack of will to prioritize justice.

🧮 The Real Cost of Fairness

This is not just about universities. The real issue is the structure of the tax code itself. We have normalized tax policy that protects accumulated wealth — but we have never designed tax policy to repair the wealth that was stolen.

We don't lack resources. We lack courage.

👕 Why the Shirts Matter

Tax Harvard. Exempt the Negro No Taxation Without Reparations

These shirts are protest signs you can wear. They simplify a complex argument into an undeniable truth. They invite conversation. They spark discomfort. And they place Black America's unpaid labor and over-taxation squarely on the national stage.

Your purchase funds this conversation — and helps push these ideas from t-shirts to tax policy.

White Paper

TAX HARVARD, EXEMPT THE NEGRO

No Taxation Without Reparations

By AJ Garvey

Summary

America's tax code has long told a story — of who is valued, who is rewarded, and who is left behind. For centuries, the wealth of this nation has been built on the backs of the enslaved and their descendants, yet the benefits of public subsidies and tax exemptions have flowed upward — to elite universities, bondholders, property owners, and corporations. This white paper calls for a seismic shift: a full federal income tax exemption for Black descendants of American slavery. It reframes tax policy as a tool of reparative justice, not just revenue. Grounded in history, constitutional analysis, and global precedent, this proposal is bold but overdue. It's time to stop asking if reparations are possible — and start asking why they haven't been prioritized.

Call to Action

The U.S. tax code is not — and has never been — neutral. It reflects our national priorities, values, and exclusions in dollars and deductions. For centuries, the tax system has operated as a quiet but potent engine of racial stratification: funding public goods through regressive mechanisms, exempting wealth while taxing labor, and rewarding property and institutional capital amassed through the very structures that denied Black people the right to build or keep wealth of their own.1

The "Negro Tax Exemption" proposal does not seek special treatment. It seeks a proportional remedy for a particular class of Americans — those whose forebears built the nation's wealth under compulsion and whose descendants have been systematically locked out of that wealth through federal policy, local exclusion, and legal neglect.2

This is not a radical concept. The tax code already grants relief to groups who meet compelling policy goals: veterans3, clergy4, homeowners5, investors6, nonprofits7, and universities8. It already reflects the idea that some forms of contribution — whether charitable, civic, or economic — deserve exemption from the ordinary burdens of taxation. What has been missing is the acknowledgment that enslaved labor was the ultimate uncredited contribution, and that Black Americans have paid taxes into a system that never truly paid them back.

Exemption is not everything. It does not repair all harms. But it is a material recognition that the American social contract was breached and that its repair must include fiscal redress. This exemption would not only correct an imbalance — it would reframe the future. It would assert, in plain legal terms, that reparative justice is not merely a question of whether we owe, but how we pay.

Policy Recommendations and Next Steps

If the tax system is to be a tool for justice and not a mechanism of exclusion, it must evolve to acknowledge and repair the racial harms it has perpetuated. Below are concrete policy recommendations and institutional steps that federal, state, and local actors can take to begin implementing a framework for the Negro Tax Exemption:

1. Congressional Action

• Amend the Internal Revenue Code to create a new tax-exempt classification for individuals who can trace ancestry to enslaved persons in the United States.

○ The exemption could apply to federal income tax and/or capital gains tax, based on reparative eligibility criteria.

○ Verification can be structured in parallel to existing standards used for tribal affiliation, veteran status, or historical social security claims.

• Establish a Reparative Tax Equity Commission to design implementation and ensure coordination with Treasury, IRS, and relevant agencies.

2. Executive Branch Implementation

• The Department of the Treasury and IRS should conduct a historical analysis of racialized tax burdens and issue guidance on racial equity in tax administration, pursuant to Executive Order 13985 ("Advancing Racial Equity and Support for Underserved Communities").

• Create a pilot exemption program through the IRS Taxpayer Advocate Service, targeting low-income taxpayers with documented ancestral ties.

3. State and Local Governments

• States with income taxes (e.g., California, New York) can model state-level exemptions or credits for reparative classes, similar to homestead or disability exemptions.

• States and local governments can structure property tax exemptions for eligible descendants and property owners.

4. Academic and Institutional Engagement

• Universities with large endowments — especially those historically tied to slavery — should develop internal frameworks to offer tax offsets or financial credits to eligible students, staff, or alumni. They may:

○ Design tax-equivalent financial aid programs for descendants.

○ Partner with legal scholars to draft model reparative tax policies.

5. Private Sector and Philanthropy

• Financial institutions can offer CRA-aligned loans and financial products that recognize the new tax-exempt status as a credit-enhancing feature.

• Foundations may fund reparative tax justice litigation and data infrastructure to support claims documentation and verification tools.

6. Public Engagement and Legal Mobilization

• Advocacy groups and public interest law firms should begin preparing test cases, FOIA requests, and model petitions for administrative review.

• Launch a national campaign — "No Taxation Without Reparations" — to educate the public, build coalitions, and generate support for the tax exemption as both a legal remedy and moral imperative.

This is not a symbolic ask. It is a fiscal reset.

As we celebrate Juneteenth, it is time to match symbolism with substance — to let tax policy reflect not just who we honor, but who we owe. To the public: this is your system. If taxation without representation was a revolutionary cause, then continued taxation despite redress must be a democratic crisis.

Let the next chapter of American tax policy begin with truth. And exemption. And justice.

Tax Harvard. Exempt the Negro.

Footnotes

1. Dorothy A. Brown, The Whiteness of Wealth (Crown, 2021); also see IRS Publication 5307: "Understanding the tax code's effects by income level and race." ↩

2. See California Reparations Task Force Final Report, Vol. 1 & 2 (2023); "The Color of Law" by Richard Rothstein (Liveright, 2017). ↩

3. 26 U.S. Code § 112 – Certain combat zone compensation of members of the Armed Forces. ↩

4. 26 U.S. Code § 107 – Rental value of parsonages. ↩

5. 26 U.S. Code § 163 – Interest (including mortgage interest deduction); see also Congressional Budget Office (2022): Distributional effects by income. ↩

6. 26 U.S. Code § 1(h) – Capital gains tax preferences. ↩

7. 26 U.S. Code § 501(c)(3) – Charitable organizations. ↩

8. Private college and university endowments are generally tax-exempt under 501(c)(3); see also 26 U.S. Code § 4968 – Excise tax on investment income of private colleges. ↩